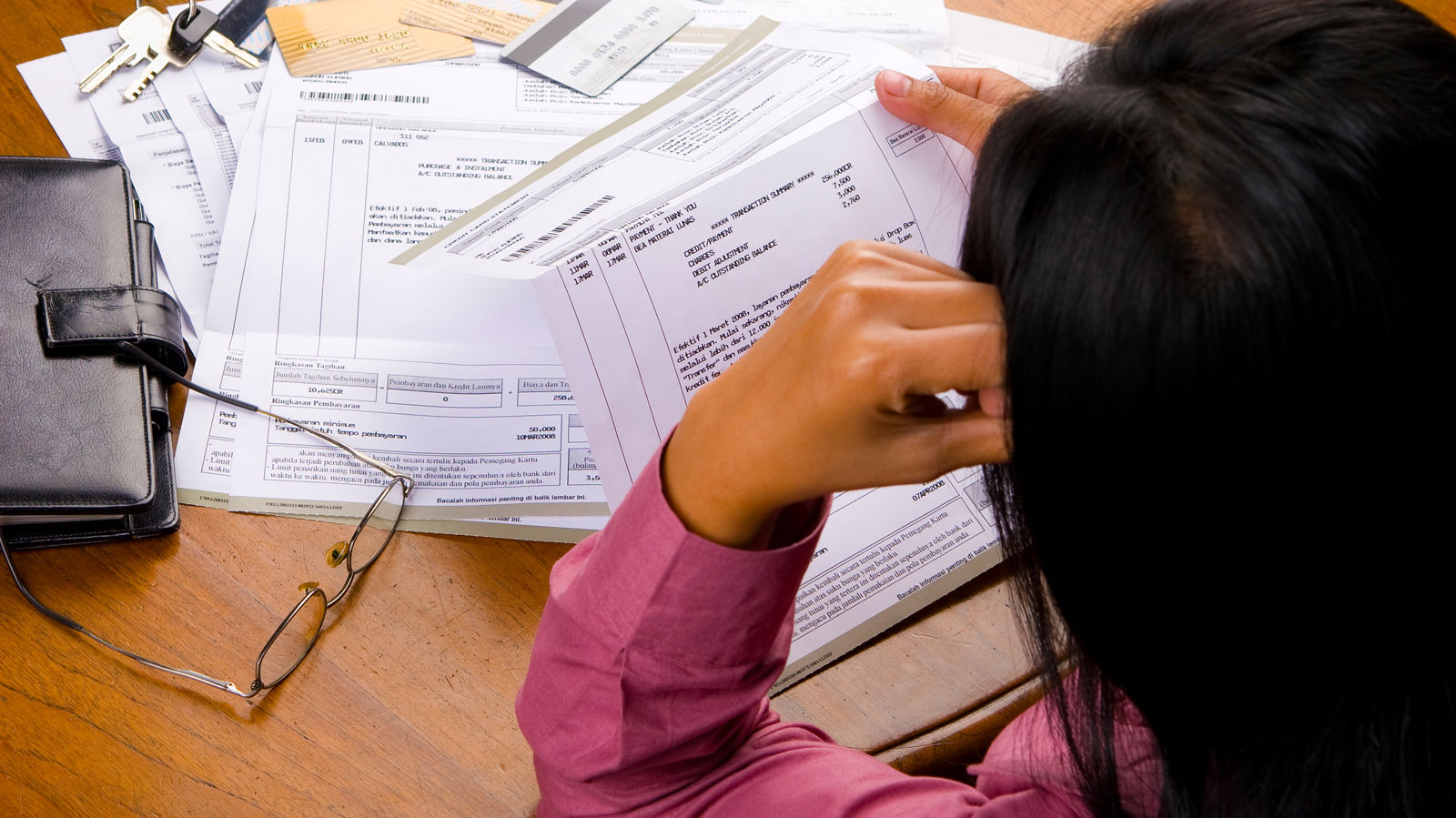

Coalition Urges Feds To Stop Rent-A-Bank Predatory Lending

Banks Should Not Scheme To Let Predators Avoid State Laws

U.S. PIRG and leading civil rights and consumer groups send letter urging FDIC board members to reinstate curbs on FDIC-supervised banks "renting" their charters to high-cost triple-digit predatory lenders seeking to evade state interest rate caps and other consumer laws.

U.S. PIRG and leading civil rights and consumer groups send letter urging FDIC board members to reinstate curbs on FDIC-supervised banks “renting” their charters to high-cost triple-digit predatory lenders seeking to evade state interest rate caps and other consumer laws.

Excerpt from downloadable resource on this page:

“FDIC-supervised banks are helping predatory lenders make loans up to 225% APR that are illegal in almost every state. These rent-a-bank schemes often operate under the guise of innovative “fintech” products, even as their high-cost, high-default business model inflicts harms similar to those inflicted by traditional payday lenders. […]

The FDIC has numerous reasons to stop its supervised banks from engaging in high-cost predatory lending. These rent-a-bank schemes:

● Are an abuse of the bank charter to facilitate loans for non-banks that are the true lender, helping them evade state laws.

● Lead to abusive lending practices as they divorce lender and borrower incentives, allowing lenders to succeed while causing severe harm to consumers.

● Pose a range of legal, safety and soundness, and reputational risks to banks.

● Carry a high risk of jeopardizing compliance with several federal laws, including the Military Lending Act, Community Reinvestment Act, the Equal Credit Opportunity Act, the Electronic Fund Transfer Act, the Fair Debt Collection Practices Act and the Fair Credit Reporting Act.

● Contradict principles of responsible lending that banking agency guidance has consistently promoted.

Rent-a-bank schemes have flourished at FDIC banks in the past few years and it is time for that to come to an end. The FDIC has the tools that it needs to prevent its banks from fronting for predatory lenders that are evading state law and making grossly high-cost installment loans and lines of credit at 100% to 225% APR. Two decades ago, the FDIC, along with the other bank regulators, used its supervisory and enforcement powers to stop banks from helping short-term payday lenders evade the law.

It is now time for the FDIC to put an end to modern predatory rent-a-bank schemes involving longer-term loans that are an even bigger, deeper debt trap.”

Topics

Find Out More

Medical Bills: Everything you need to know about your rights

How printers keep us hooked on expensive ink