Virtual Wallets, Real Complaints

New report documents consumer complaints to the CFPB about digital wallets and peer-to-peer (P2P) apps.

Downloads

How digital payment apps put consumers’ cash at risk

CALPIRG Education Fund

Summary

Consumers are increasingly using digital payment apps for convenience. The peer-to-peer (P2P) apps were originally marketed as a way for friends to split expenses. But, perhaps due to a concern for contactless payments during a pandemic, consumers are using them for more and more transactions, opening their bank accounts to scammers.

Consumers don’t realize that the instantaneous transactions are not reversible, nor that they have fewer consumer protections when they use a payment app or service. So, complaints are way up. The three most commonly complained-about issues involving digital wallets are problems managing, opening or closing accounts; problems with fraud or scams; and problems with transactions (including unauthorized transactions).

Tips for consumers

When you use a peer-to-peer (P2P) payment app, you have fewer rights by law and are vulnerable to more threats from scammers.

- Using a P2P app is like spending cash. Only use it for friends and others you both know and trust. Transactions are instantaneous and generally not reversible.

- If possible, keep one, separate bank account to link to P2P accounts. Do not link P2P accounts to your primary account or one with a sizable balance.

- If you are going to send money to a particular person for the first time through a P2P payment app, such as Venmo, for example, even to a person you know, you should either initially send $1 as a test or ask the person to send a request for the money. There are so many accounts that have similar names such as BobSmith1 and BobSmith02. The accounts can have photos, but the photos are so small, it’s difficult to tell whether it’s the correct person.

- Bottom line for consumers: Don’t use P2P with strangers, beware of phishing or unexpected requests, and double check usernames.

Recommendations

Policymakers should strengthen consumer protections on payment apps to:

- Ensure that consumers are protected if they are defrauded into sending money.

- Require app providers to investigate errors and fraud even when the consumer made the mistake or sent the money.

Topics

Find Out More

Medical Bills: Everything you need to know about your rights

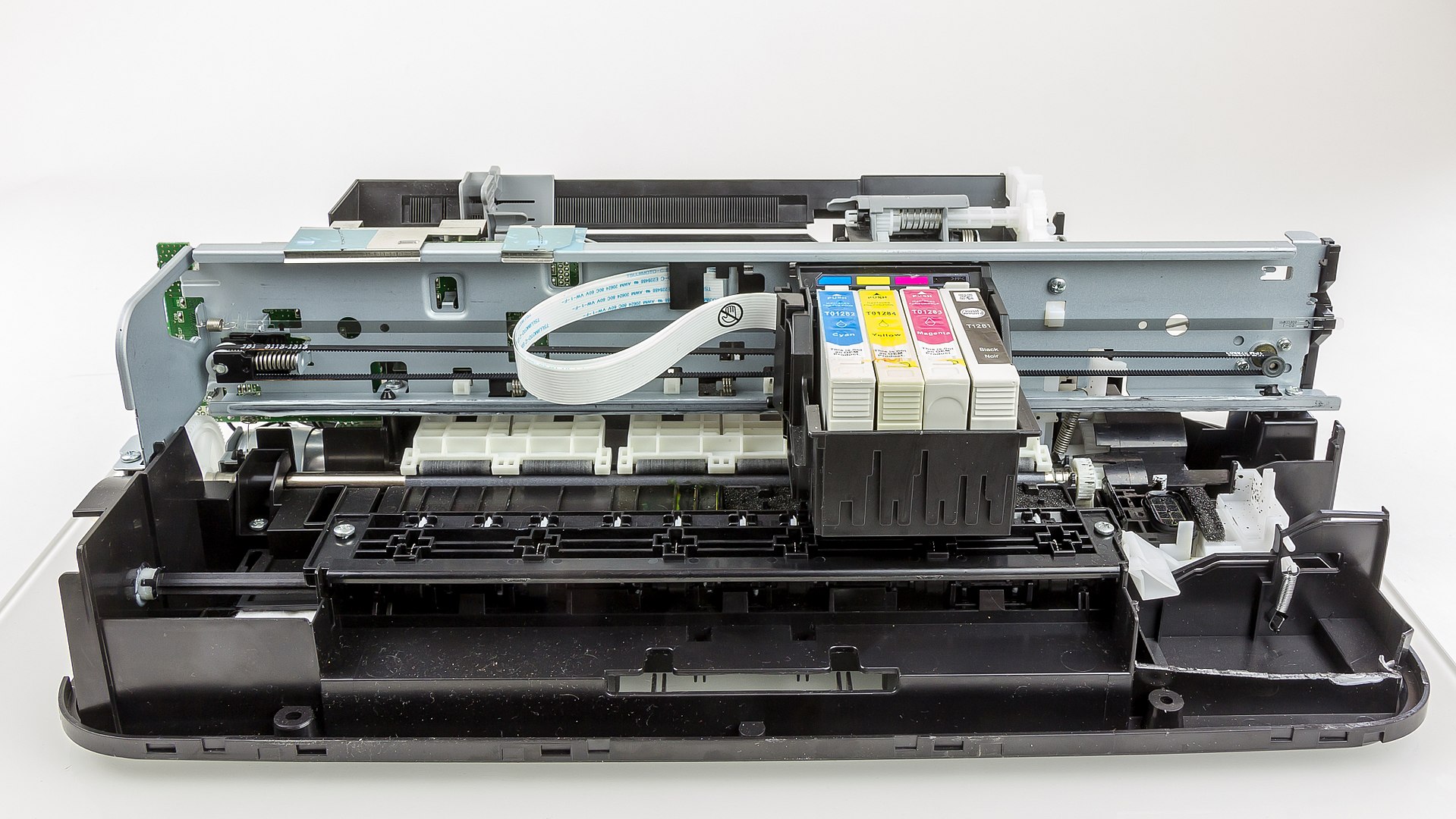

How printers keep us hooked on expensive ink