Wisconsin’s Debt Trap

A Look at High-Cost Lending in America’s Dairyland

This report analyzes the 10 high-cost lending companies with the most locations in Wisconsin and provides recommendations for protecting Wisconsinites from high-cost debt traps.

Findings

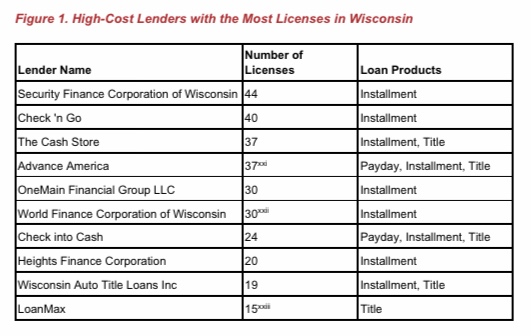

The Wisconsin Department of Financial Institutions (WDFI) keeps lists of licensed payday lenders and other loan companies that provide loans with APR over 18%. We researched the companies with the most licensed locations on both lists to compile a list of ten high-cost lenders with the most licenses in Wisconsin. See Figure 1 and Methodology.

The top ten high-cost lending companies with the most locations in Wisconsin have a total of 296 licenses. Nine of these ten companies offer installment loans.

A sampling of example APRs and payment schedules found using loan calculators on some lender websites shows how interest and fees can add up.

The Cash Store’s loan calculator indicates an APR of 520% for a $300 installment loan, with 13 payments of $66.19 due every 14 days. That adds up to a total of $860.47, or 2.9 times the amount borrowed.

Advance America’s loan calculator shows that a $1,500 installment loan paid back monthly in cash for a year at 264.83% APR would cost a total of $4,822.05. That is 3.2 times the original amount borrowed.

OneMain Financial’s calculator shows that a $10,000 five year loan at 36% APR comes with estimated monthly payments of $361. That adds up to $21,660, or 2.2 times the amount borrowed.

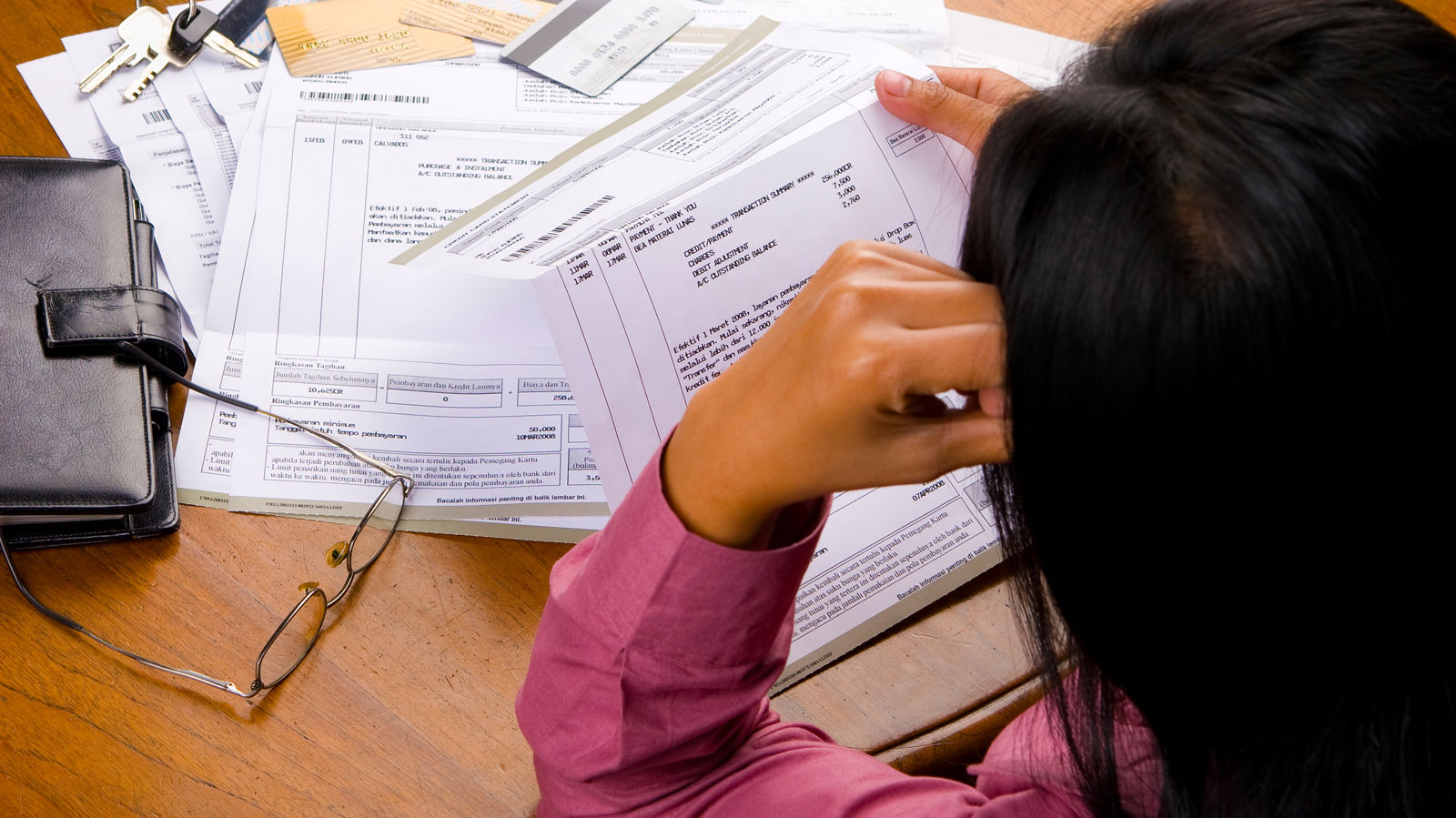

Understanding why consumers take out predatory loans sheds more light on why they are especially dangerous. Most consumers take out these high interest loans not for unexpected emergency expenses, but for recurring expenses such as rent and utility payments. 69% of first time borrowers take out loans to “cover a recurring expense, such as utilities, credit card bills, rent or mortgage payments, or food.” Additionally, American households making less than $40,000 a year are 62% more likely to take out a payday or high-cost loan. Taking out high-cost loans will only make a bad financial situation worse for consumers who are already having trouble making ends meet.

Wisconsin is not immune to these economic hardships, and high-cost lenders take advantage of this. In fact, payday and car title fees drain $111,154,821 from Wisconsinites annually.

Topics

Find Out More

Medical Bills: Everything you need to know about your rights

How printers keep us hooked on expensive ink