MASSPIRG joins AG Panel for Consumer Week

I was honored to participate in Massachusetts Consumer Rights Panel hosted by the Attorney General Maura Healey's office in honor of National consumerprotectionweek.

I was honored to participate in Massachusetts Consumer Rights Panel hosted by the Attorney General Maura Healey’s office in recognition of National consumerprotectionweek. I spoke in support of critical updates to the Used Car Lemon Law to protect consumers. We were also joined by the bill sponsors, Senator Paul Feeney and Representative Carlos Gonzalez.

MASSPIRG supported the passage of the Lemon and Lemonade laws, the used vehicle warranty law and many other important laws protecting consumers in the Commonwealth. We strong support S.2323/H.3777, An Act modernizing protections for consumers in automobile transactions, filed by Senator Feeney and Representative Gonzalez supported by Attorney General Healey which will make common sense updates to our used car laws.

A car is one of the biggest, most important purchases consumers make, second only to buying a home. The impacts of purchasing a defective or unsafe car can have a devasting effect on consumers and their families. The average used car price as of November 2021 was $29,011, and even more striking is that the average cost for a used car that is 9 years old was $14,124. While these prices are elevated as result of COVID19 market disruptions, even pre-pandemic prices represent a significant investment.

Car purchases are fraught with problems, in large part because consumers are not auto mechanics and don’t purchase cars frequently. It is an area where unscrupulous dealers can take advantage of consumers by selling them a defective or unsafe car. In fact, car complaints (about 3,000) are the number one consumer complaint to the Attorney General’s office every year.

When, or if, a car does not work as it was supposed to, consumers often face significant costs to repair the car, finding alternate transportation for work, school and other transportation needs.

S.2323, H.3777 An Act modernizing protections for consumers in automobile transactions makes the following improvements to our used car consumer protections:

The Lemon Aid Law provides consumers the right to obtain a full refund if the used vehicle they have purchased fails an inspection within 7 days of the date of sale.

Consumers are experiencing administrative delays that prevent them from taking possession of the vehicle and obtaining a timely inspection. According to the AG’s office some dealers knowingly take advantage of this provision: recognizing the vehicle they are selling will likely fail a state inspection and keep the vehicle on the premises under the guise of “cleaning and touch-ups” until the 7 days run out.

This bill closes that loophole by providing consumers 7 days from the date of delivery (vs. sale) to inspect their vehicle.

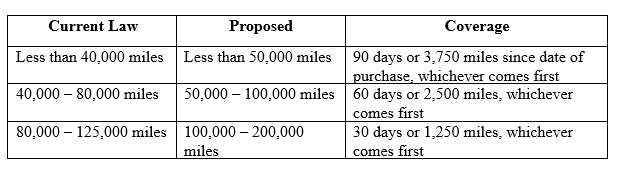

The Used Vehicle Warranty Law sets minimum warranty periods, based on the mileage of the vehicle at the time of purchase, during which the dealer must take in the vehicle to repair defects that affect its use or safety. If the dealer cannot fix the defect after three reasonable attempts, a consumer can return the vehicle.

Currently, the law only covers vehicles with 125,000 miles or less at the time of purchase, leaving a class of consumers that purchase vehicles with higher mileage for their affordability unprotected if the vehicle has serious issues.

This bill would increase the maximum mileage for coverage under the law to 200,000 miles and adjusts the categories of warranty periods, to the benefit of consumers:The Lemon Aid Law provides consumers the right to obtain a full refund if the used vehicle they have purchased fails an inspection within 7 days of the date of sale.

Consumers are experiencing administrative delays that prevent them from taking possession of the vehicle and obtaining a timely inspection. According to the AG’s office some dealers knowingly take advantage of this provision: recognizing the vehicle they are selling will likely fail a state inspection and keep the vehicle on the premises under the guise of “cleaning and touch-ups” until the 7 days run out.

The bill closes that loophole by providing consumers 7 days from the date of delivery (vs. sale) to inspect their vehicle.

Improving recourse for consumers

Currently, all used car dealers are required to have a $25,000 surety bond for each business name the dealer operates under and each municipality it operates in. The bond offers a way for consumers who suffer a financial loss as a result of the dealer’s actions to obtain recourse.

Vehicles are more expensive to own and repair; the current required amount is not enough to adequately compensate consumers that are stuck with inoperable vehicles and significant loan payments. Further, consumers must obtain a court judgment in order to recover against the bond. This closes off access to vulnerable consumers who do not have the resources to navigate the court system and consumers who fear putting their immigration status in jeopardy.

The bill would increase the amount of the surety bond to $50,000 per business name a dealer operates under, per municipality and permit the Attorney General to file a claim against the bond on behalf of a class of consumers. It would also remove the court judgment requirement, thereby allowing consumers to file a claim directly with the insurance company that executes the bond.

Leased vehicle repossession

If consumers of financed vehicles fall behind on payments, and are at risk of repossession, lenders are obligated to provide notice and an opportunity to remedy the non-payment. The same is not true of consumers that lease their vehicles; currently, a lessor can repossess a leased vehicle without providing any notice, or an opportunity to address a missed payment.

The bill adds notice and right to cure requirements for leased vehicles, like what is required of financed vehicles.

Topics

Find Out More

A look back at what our unique network accomplished in 2023

Mastercard, don’t sell my data